Building a Board of Directors: Part Two

In Part 1 of this series, we explored the various factors you should consider when setting up a Board of Directors. In part 2, we’ll discuss the elements needed to manage a board, what goes into running effective meetings, as well as what to consider when measuring success.

Managing a Board of Directors

The first thing most people think about when they hear the term Board of Directors is the board meeting. Of course, these meetings are where the action happens, but there’s a lot of work to be done before and after the meetings, especially when building relationships and fostering trust.

You will learn a lot on your journey as a startup founder, and learning to lead a board isn’t easy, but bearing in mind the following basic principles should help.

Start by building trust

If you are the CEO or will be acting as Chairman of the Board, it’s up to you to keep everyone aligned and on the same page so that board meetings are productive.

José del Barrio Puerta, founding partner at Samaipata and experienced board member, explains: “While co-founders are working 24/7 together, they know every single detail of their businesses, they speak all the time and have many informal ways to communicate with each other; board members have way less access to business information and to informal communication channels with founders. Thus, the possibilities of misalignment between founders and board members are way bigger”.

He shares the following ways to improve communication with your board:

- Foster personal relationships among board members to increase trust and communication e.g. through spending ‘social time’ together.

- Hold one-to-one catch-ups before and after board meetings to align positions, avoid misunderstandings and gather feedback.

- Stay in frequent informal communication through slack, Whatsapp, calls etc.

- Create a process for frequent and well-structured reporting.

Understand the purpose of board meetings

If you have played your cards right and managed to put together a transparent, committed and experienced board, you should never feel under pressure to ‘prove your worth’ in every board meeting.

Too many founders are intimidated by their boards, and as a result spend too much time trying to prove the business is doing well and not enough time focusing on their weak points or discussing their concerns or failings.

This is a real pity as board meetings are the ideal place to take a step back from the day-to-day job of running your business, and think about your vision, strategy and progress. The Board of Directors is there to give you feedback and be helpful.

Prepare for board meetings well in advance

Board meetings usually take place monthly or bi-monthly, and last for 2-3 hours.

As the CEO, there are two major things you need to prepare ahead of each meeting:

- A monthly report on the health of the business and how it is progressing towards its goals. Share a comprehensive monthly reporting dashboard that covers the high-level metrics as well as detailed financial and cash-flow figures early on. This is one of the best ways to ensure everyone understands the business and what it needs. A short slide deck accompanied by the report should be shared with board members a few days before the meeting.

- A list of important issues or concerns you would like the board to discuss in greater detail. It’s best to send a short summary of these challenges to the board ahead of the meeting, so that they have enough time to digest and think about the issues.

It isn’t always easy to keep the meetings under three hours, but if you prepare well (and if attendees read what you send them), you can maximise meeting productivity.

- Schedule the meetings a year in advance and stick to the date. Board members are typically very busy, so booking meetings in advance as well as sticking to set dates is vital.

- Prepare well. Get your reports ready and share them 48–72hrs in advance so every director has enough time to go through them.

- Follow a well-structured agenda. A common agenda includes: a general update from the CEO, time to discuss strategic decisions, board-member-only time, voting time.

- Build in social networking time. It’s a good idea to schedule a group lunch or dinner after each board meeting to help build relationships and give people more time to discuss important topics.

- Share a list of action items or minutes after each meeting. This is another way to set expectations and ensure that everyone is aligned on what the outcomes of the meeting are.

Facing up to your very first board meeting can be an intimidating experience. Preparation is paramount, and as long as you have that locked down, your initial meeting can set the tone for productive meetings to follow too.

Here are a few tips to remember, in addition to the suggestions above:

- Create a trial run for yourself. You could even rope in another, more experienced founder to guide you.

- Understand your audience. Reading the room is important, so get to grips with who your board is and do your research about what they value. You’ll then be able to anticipate the questions they may have.

- Be receptive to feedback and set realistic expectations. Set the scene for transparency, honesty and efficiency at the start.

- Information is good, but insight is better. It’s easy enough to find stats and state facts, but they aren’t very helpful unless you can link them to the growth of the business. As José del Barrio Puerta explains in his article: “Instead of saying ‘sales dropped a bit last month’ you can say our ‘website conversion rate went down from 5% to 4.1% due to page load time caused by a technical issue related to AWS servers. [This] caused a sales drop of ~20% last month, we have fixed it already and now we’re seeing week-on-week growth again and expecting to close this month +10% above pre-issue levels’”.

Consider inviting your leadership team to board meetings

Aside from your 3-5 board members, it can be helpful to invite your leadership team to join the meeting too. They’ll hear board feedback straight from the horse’s mouth, and you may find that future reporting, and even performance, improve when people have to present their results in person!

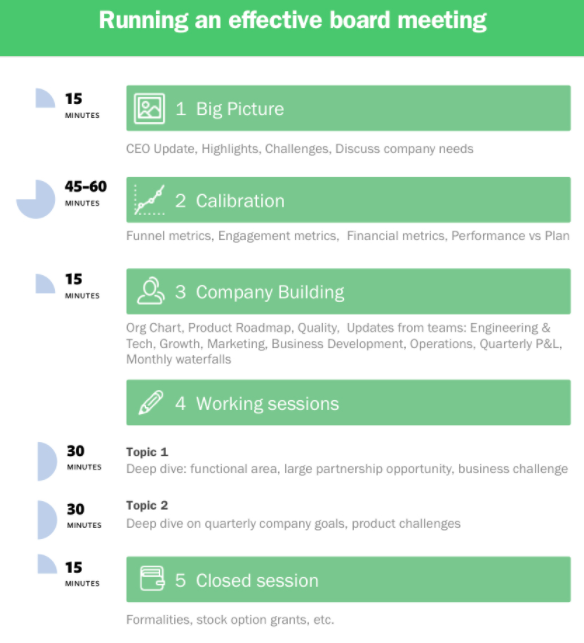

How to structure your meetings

You might not be accustomed to following a structured agenda for meetings, but as more investors join your board, you will need to find a good way to maximise your time in board meetings.

Sometimes VCs will ask you to structure your meetings a certain way, as Baz Banai, Private Equity Lawyer at Linklaters, shared in a recent article.

The board desk approach

Sequoia Capitalis a well-known Silicon Valley VC firm that uses ‘board decks’ to help founders maximise the value they get from board meetings. The following structure is used by the likes of Dropbox, TuneIn, and Thumbtack.

The board triangle approach

Jon Callaghan, the Managing Partner at True Ventures, has a different take on it. He uses the Board Triangle as an interaction model for startup CEOs. The three ‘points’ - strategy, leadership and reporting - form the Board Triangle, and CEOs use these to manage the topics of discussion as well as the allocation of time.

The above two approaches are helpful, but in reality you will probably find that your meetings follow some sort of hybrid approach. As long as you understand what you need to cover and why, you’ll be well on your way to running effective board meetings.

Measuring & (re)evaluating your board’s success

Once your board takes shape, it’s important to review, reflect and reinforce why you set it up in the first place. Are the outcomes you needed to achieve being met?

Sir Andrew Likierman, Dean of the London Business School defines certain factors to consider when evaluating the board in this article. He believes you should ask:

- Does the board have the ability to choose members with the right balance of qualities and skills?

- Does the board agree about its priorities and functions?

- Is the board in agreement on how to achieve the company’s strategy?

Ultimately he outlines that if the board is hopelessly divided on basic matters about whether to grow organically or inorganically, or the appetite for risk, the probability of success declines dramatically.

Measurement and assessment of board performance should also consider the speed at which the board makes decisions, and how basic culture, atmosphere and relationship dynamics work within the team.

Consider whether:

- The board can hone in on key risks that need to be addressed.

- Elected members can identify weaknesses that could become greater issues.

- Members are capable of conducting crisis management.

Concluding thoughts

Leading a business through funding rounds and resulting growth is not going to be easy. Your business might change more than you expect and you’ll certainly make mistakes along the way. An experienced, transparent, and helpful Board of Directors will lighten your burden and help to avoid some of the common pitfalls.

It’s important to take the time and find the right people to help steer your business; then you need to learn how to manage them effectively and ensure your business is led with purpose and vision.